It is important for travelers and those sending money internationally to know how to check currency rate; in order to ensure that they are getting the best value for their money. Currency rates fluctuate constantly, and even small differences in exchange rates can have a significant impact on the amount of money that travelers and international money senders ultimately receive or spend.

Travelers and anyone sending money abroad may make educated judgments about when and where to exchange currencies or conduct international transactions by consulting currency rates. The advice in this post will help you examine currency exchange rates and find the greatest deals.

Explore more about exchange rate concepts: How To Convert Currency – Understand Exchange Rates

Online resources for checking currency rates

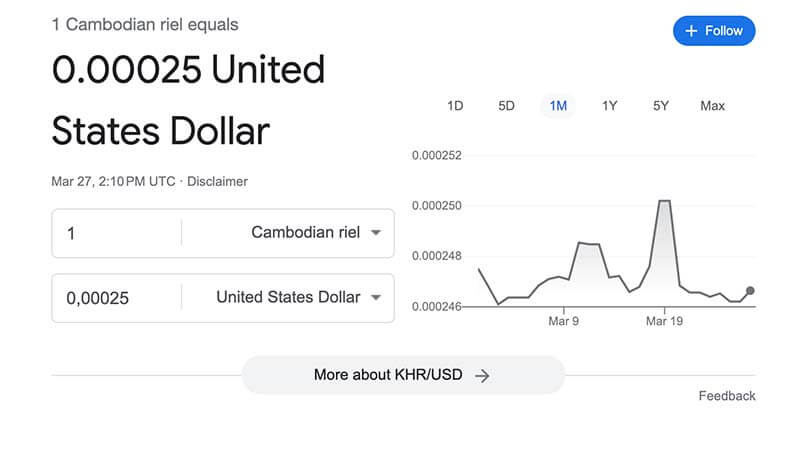

The swiftest online resource for currency checking is definitely Google – providing a quick and easy way to check currency rates directly from its search engine.

Advantages

- Quick and easy to use

- Provides up-to-date exchange rates

- Can be accessed from any device with internet access

Disadvantages

- May not provide as much detail as other online resources

- May not display all available currencies

Steps for using Google to track currency rates

- Go to the Google search engine (google.com), or go to: This page

- Type in the currency pair you want to check (e.g. “USD to EUR”)

- View the current exchange rate

Otherwise, you can try using online currency exchange platforms such as XE or Wise or your local bank to explore more. These exchange rate checking pages may has slightly different rates due to their policies and updating algorithm.

Mobile apps for checking currency rates

Currency Converter Plus

Another well-liked smartphone application for examining exchange rates is Currency Converter Plus. Both iOS and Android smartphones may use it. The software offers up-to-date exchange rates for more than 160 different currencies and gives users the option to simultaneously track numerous currencies.

Advantages

- Provides accurate and up-to-date exchange rates

- Supports a wide range of currencies

- Allows users to track multiple currencies at once

- Offers a customizable interface

Disadvantages

- The free version of the app contains ads

- Some users report occasional glitches or inaccuracies

How to use

- Download and install the Currency Converter Plus app from the App Store or Google Play.

- Open the app and select your base currency from the list.

- Select the currency you want to convert to.

- Enter the amount you want to convert.

- The app will display the current exchange rate and the converted amount.

Easy Currency Converter

Easy Currency Converter is a simple and straightforward mobile app for checking currency rates. It is available for both iOS and Android devices. The app provides up-to-date exchange rates for over 180 currencies, as well as the ability to save your favorite currencies for quick access.

Advantages

- Provides accurate and up-to-date exchange rates

- Supports a wide range of currencies

- Offers a simple and easy-to-use interface

- Allows users to save favorite currencies for quick access

Disadvantages

- The free version of the app contains ads

- Some users report occasional glitches or inaccuracies

How to use

- Download and install the Easy Currency Converter app from the App Store or Google Play.

- Open the app and select your base currency from the list.

- Select the currency you want to convert to.

- Enter the amount you want to convert.

- The app will display the current exchange rate and the converted amount

Using credit cards for international transactions

When you use a credit card for international transactions, the currency conversion is typically done by the credit card company. Here’s how it works:

The credit card provider will translate the cost of the purchase made in a foreign currency into your local currency. The wholesale rate, usually referred to as the interbank rate, plus a markup is normally the conversion rate utilized by the credit card provider. The markup might differ amongst credit card providers, however it typically ranges between 1 and 3%. Your credit card statement will then be updated with the converted amount in your local currency.

Advantages of using credit cards for international transactions

- Convenience: Using a credit card is easy and convenient, and you don’t have to worry about carrying cash or exchanging currency.

- Safety: Credit cards offer better fraud protection than cash or debit cards. If your card is lost or stolen, you can easily report it and get a new one.

- Rewards: Many credit cards offer rewards or cash back for purchases, including those made internationally.

Disadvantages of using credit cards for international transactions

- Fees: Some credit cards charge fees for foreign transactions, including a foreign transaction fee and a currency conversion fee.

- Exchange rates: Credit card companies may use a less favorable exchange rate than what is available in the market, which means you could end up paying more for your purchase.

- Interest rates: If you carry a balance on your credit card, you’ll be charged interest on the balance, which can add up quickly.

Tips for getting the best currency rates when using credit cards

- Make use of a credit card without a foreign transaction fee.

- Choose a credit card with a minimal foreign exchange rate charge.

- Use a credit card that provides rewards or cash back on transnational purchases.

- Keep an eye on the currency rate and buy when it is beneficial.

- To prevent interest costs, pay off the entire balance on your credit card each month.

Using money transfer services

There are several money transfer services that can be used to send money internationally. Here are three recommended options:

Liberty Exchange & Transfer

Another service that enables international money transfers is Liberty Exchange & Transfer. More than 14 nations and territories are represented through its network of agents. Online or in person at one of its physical locations, you may send money. Liberty Exchange & Transfer has the benefit of providing reasonable costs and competitive exchange rates. Its smaller network than that of other money transfer businesses means that your selections may be limited.

Learn more about Liberty App: Liberty App – A New Foreign Currency Online Conversion App in Cambodia

Western Union

With more than 150 years of experience, Western Union is a well-known provider of money transfers. You may send money to more than 200 nations and territories with it. The Western Union website, smartphone app, or a physical station are all ways to send money. Western Union has the benefit of being well-known and having a sizable global agent and location network. Its cost, together with exorbitant fees and poor exchange rates, is a drawback.

PayPal

More than 200 nations and territories can be reached by using the well-known online payment service PayPal. Your PayPal account, debit card, or credit card can all be used to transfer money. The fact that PayPal is well-known and simple to use is a plus. Having high fees and unfavorable currency rates might make it pricey, which is a drawback.

Tips for getting the best currency rates when using money transfer services include:

- Compare costs: To locate the most affordable choice, evaluate the costs and rates of several providers before selecting a money transfer service.

- Examine exchange rates: To determine how much you will get in the recipient’s currency, utilize a currency converter and be mindful of the current exchange rates.

- Decide on the local money: To avoid additional costs and unfavorable conversion rates, transfer and receive money wherever feasible in the local currency.

- Look out for additional costs: Be aware of any additional costs that could be applied to your transfer, such as withdrawal or transaction costs or fees for currency conversion.

Exchange rate alerts

Exchange rate alerts can be set up using various online services, such as XE, TransferWise, or Oanda. These services allow users to set up personalized alerts to notify them when a currency reaches a certain exchange rate.

Advantages

- Exchange rate alerts can help travelers or international money senders save money by notifying them when a currency reaches a favorable exchange rate.

- They can be customized to specific currencies and exchange rates, allowing users to target their alerts to their specific needs.

- Alerts can be sent via email or mobile notifications, providing users with real-time information.

Disadvantages

- Exchange rate alerts may not be completely accurate, as they are based on real-time market data that is subject to fluctuations.

- Users may receive an overwhelming number of alerts if they set up too many, making it difficult to determine which ones are most important.

- Some exchange rate alert services may charge fees for their services.

Steps for setting up exchange rate alerts

- Choose an exchange rate alert service.

- Create an account or sign in to your existing account.

- Select the currencies you want to monitor and the exchange rate thresholds you want to be notified about.

- Choose the notification method you prefer, such as email or mobile notifications.

- Save your settings and wait for the alerts to start coming in.

Conclusion

This page offers a thorough description of the many methods for comparing exchange rates, such as mobile applications, credit cards, and money transfer services. It also emphasizes how crucial it is for tourists and anyone sending money abroad to keep track of currency rates because it may help them save money.

The article also offers advice on how to find the best conversion rates, such as how to set up exchange rate notifications and how to use online comparison tools. In general, we anticipate that readers will be proactive in locating the best exchange rates and will utilize the information offered to make educated judgments by reading the article.